The new tax slabs proposed by Finance minister today is lower than the earlier tax slabs. But there is a catch! You need to forego all the tax exemptions! The minister has said that the present tax regime has too many exemptions and deductions. Due to this, it has become the norm to engage a professional to file taxes. The objective is to make the process simpler so that you can file your taxes on you own. The new slabs are entirely optional. This means you need to calculate your tax liability under the old regime and the new regime. You are free to choose the one where your tax liability is lower.

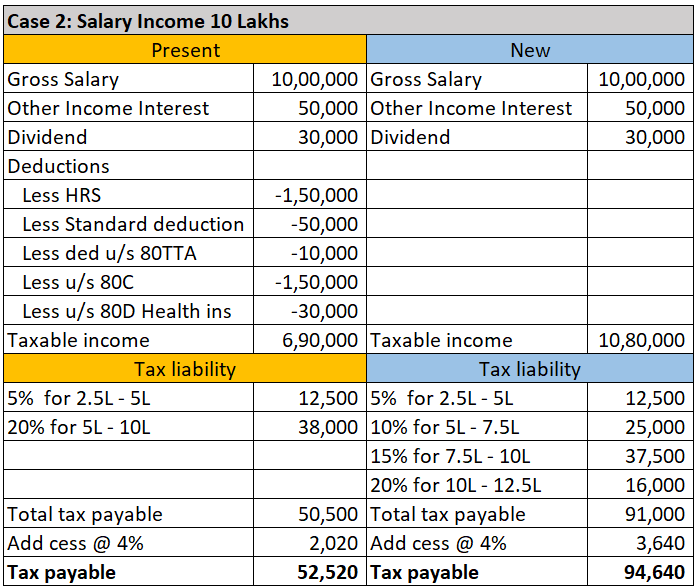

Let us calculate and check a few cases. All of them are salaried.

If you are not using Home loan interest deduction and House rent subsidy and some of the other deductions, then the new tax slab will reduce your tax liability.

Conclusion

The new tax slabs definitely avoid complexity. However, you may end up paying more in taxes! You could be better off still using the old method of calculation. You need to calculate your tax liability using the old slabs and the new slabs. For the FY 2020-21, you can choose either the old or the new slab based on which one is suitable for you.